NextEra Energy Partners (NYSE: NEP) has battled persistent headwinds over the past couple of years. Rising interest rates have made it more challenging for the company to refinance existing funding and finance its growth. Those issues have weighed on the renewable energy stock, driving its dividend yield up over 12%.

Despite those headwinds, the renewable energy company has been able to continue growing. Its earnings, cash flow, and dividend all rose in the first quarter. Meanwhile, it sees more growth ahead.

Growing despite the headwinds

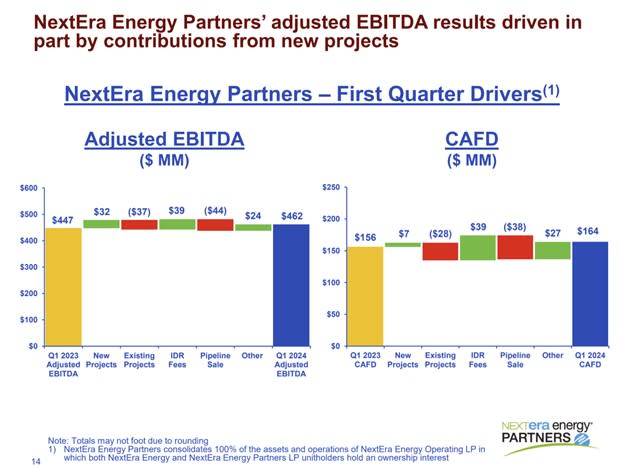

NextEra Energy Partners delivered modest earnings and cash flow growth during the first quarter:

As that slide shows, the company’s adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) rose from $447 million to $462 million, a 3.4% increase. The company benefited from new projects…