The $14.9 billion sale of iconic steelmaker US Steel (X) to Japan’s Nippon Steel ends months of speculation over industry consolidation in a move criticized by union workers, but seen by one analyst as a win for US manufacturing.

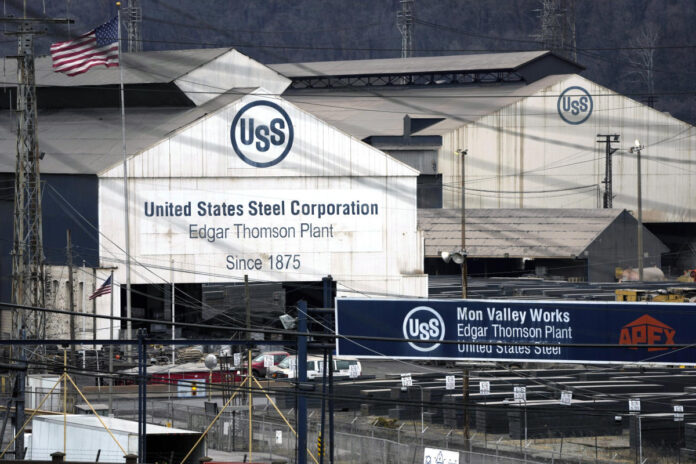

Nippon Steel, which already owns and operates assets in the US, announced on Monday it will buy the 122-year-old steelmaker for $55.00 per share. US Steel’s stock jumped as much as 28% after the announcement.

The price is notably higher than the $35 per share offered by Cleveland-Cliffs (CLF) in August in a bid that was rejected and made public by US Steel.

“The valuation, to me, it’s the high end but it doesn’t look excessive,” Josh Spoores, steel analyst at CRU Group, told Yahoo Finance.

Nippon Steel says it will honor all agreements between US Steel and the United Steelworkers Union (USW). However the union, which supported the Cleveland-Cliffs bid,…