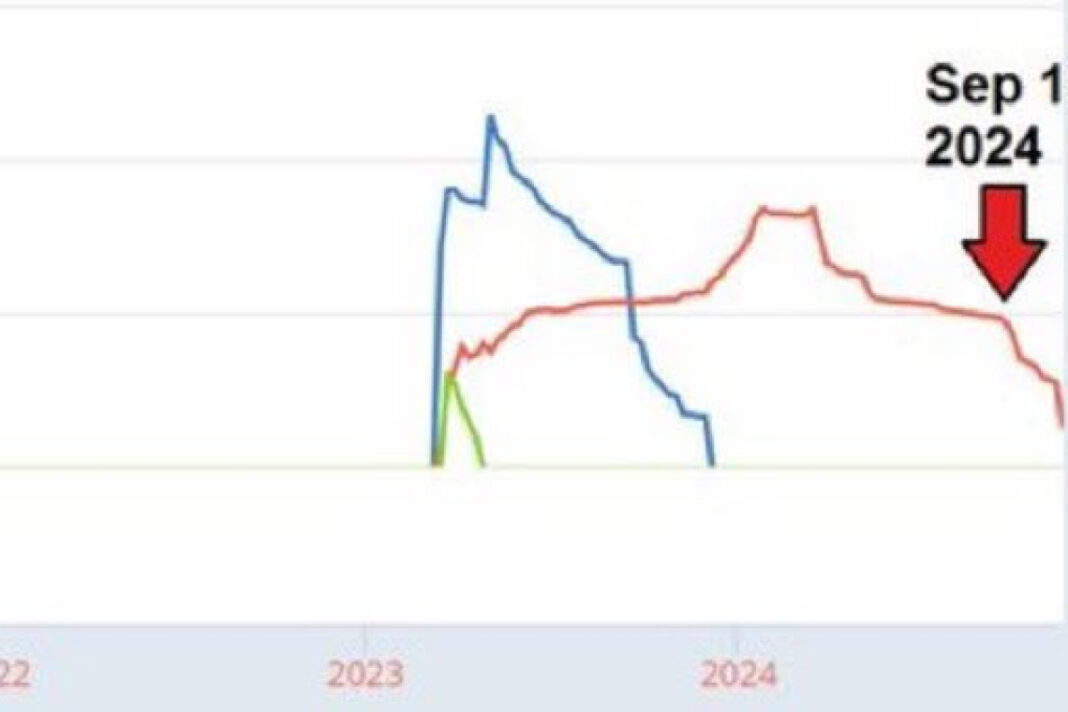

The Federal Reserve “pulled” about thirty billion dollars ($30 Billion) of available credit from its Bank Term Funding Program, and many people are saying this lack of liquidity for banks, is going to cause a “crash..”

Financial Gurus are sounding the alarm on social media:

🚨BREAKING NEWS🚨

THE FEDERAL RESERVES BTFP DROPPED BY OVER $30B THIS WEEK WHICH LEAVES ONLY $26B LEFT

POWELL IS PULLING LIQUIDITY TO TRIGGER A CRISIS JUST LIKE 2020,ALSO COINCIDENTALLY THE $36T DEBT CEILING WILL HIT TOMORROW

WE ARE ABOUT TO EXPERIENCE A 1929 LIKE CRASH…$SPY pic.twitter.com/2lV6ZoEbkD

— Mike Investing (@MrMikeInvesting) November 15, 2024

In response to the 2023 United States banking crisis in March 2023 involving multiple failures of American banks, in 2023 the United States government took extraordinary measures to mitigate fallout across the banking sector.

On March 12, the…