(Bloomberg) — A Fidelity International money manager has sold the vast majority of US Treasuries from funds he oversees on expectations the world’s biggest economy still has room to expand.

Most Read from Bloomberg

Singapore-based George Efstathopoulos, who helps manage about $3 billion of income and growth strategies at Fidelity, sold the bulk of his 10-year and 30-year Treasuries holdings in December. He is now turning to assets that typically do well in times of good economic growth to boost returns.

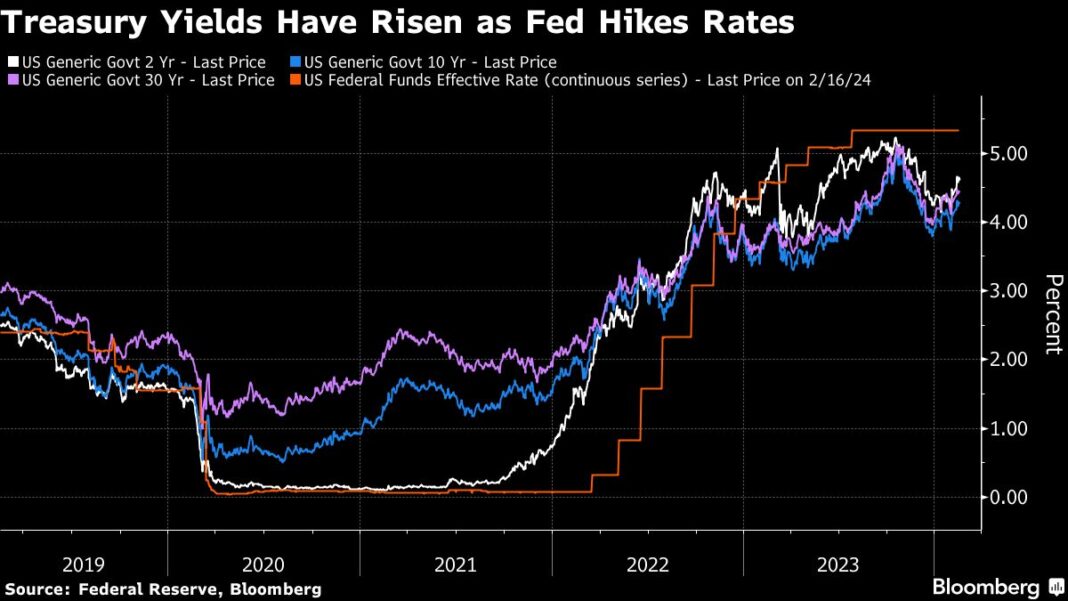

“We don’t expect sort of a recession anymore,” said Efstathopoulos. “The probability of no landing is still small, but it’s been increasing. If that increases much more, potentially we will not be talking about Fed cuts anymore” in 2024.

Efstathopoulos is among those cooling on Treasuries as the US economy’s resilience forces investors to rethink bets on interest-rate…