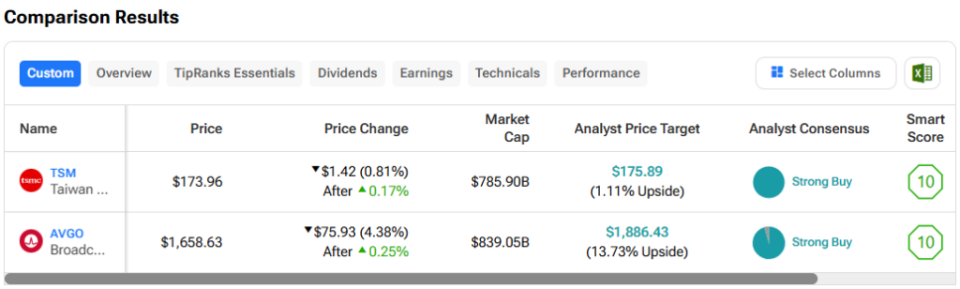

In this piece, I evaluated two semiconductor stocks, Taiwan Semiconductor Manufacturing (NYSE:TSM) and Broadcom (NASDAQ:AVGO), using TipRanks’ Comparison Tool to see which is the better buy. A closer look suggests a bullish view of TSM and a neutral view of Broadcom.

Taiwan Semiconductor Manufacturing manufactures and sells semiconductors for several end markets, including gaming consoles, servers, tablets, and computers, the automotive market, the Internet of Things, and other digital consumer electronics. On the other hand, Broadcom’s chips target the renewable energy, automotive, military and aerospace, industrial, and robotics markets.

Shares of TSM have soared 71% year-to-date and are up 76% over the last year. Meanwhile, Broadcom stock has jumped 49% year-to-date and is up over 100% in the last year.

The differing 12-month returns of TSM and Broadcom are suggestive of the…