(Bloomberg) — Central bankers continued their forceful push-back against market bets for interest rate cuts, deepening a global selloff across stocks and bonds.

Most Read from Bloomberg

European Central Bank President Christine Lagarde and Governing Council member Klaas Knot warned on Wednesday that aggressive bets on interest-rate cuts aren’t helping policymakers in the battle to subdue inflation. That followed comments on Tuesday from Federal Reserve Governor Christopher Waller, who urged caution on the pace of easing.

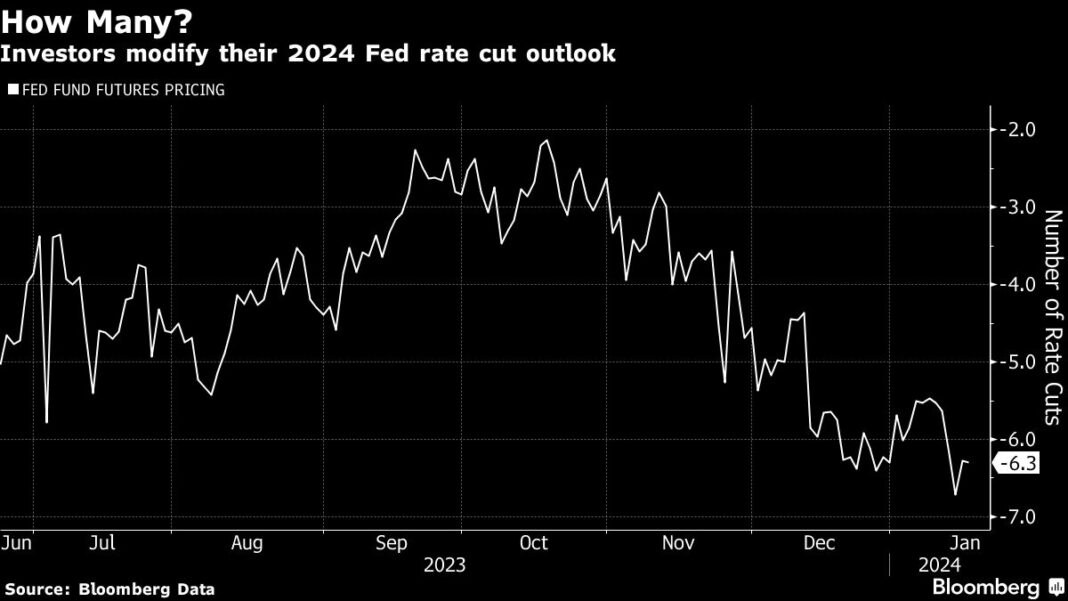

Swaps market pricing for a Fed rate cut in March has dropped to around 65% from 80% on Friday, while money markets pushed back bets on the timing of the ECB’s first quarter-point cut to June, from April. German two-year yields — among the most sensitive to changes in monetary policy — rose five basis points to 2.65%.

The Stoxx Europe 600 index slumped more than…