(Bloomberg) — For some, a slump of almost 60% is a signal to buy Chinese stocks.

Most Read from Bloomberg

Almost a third of 417 respondents to Bloomberg’s latest Markets Live Pulse survey say they will increase their China investments over the next 12 months. That compares with just 19% in a similar August survey and is higher than the 25% who planned to boost exposure in March. Only a fifth now anticipates cutting their China holdings.

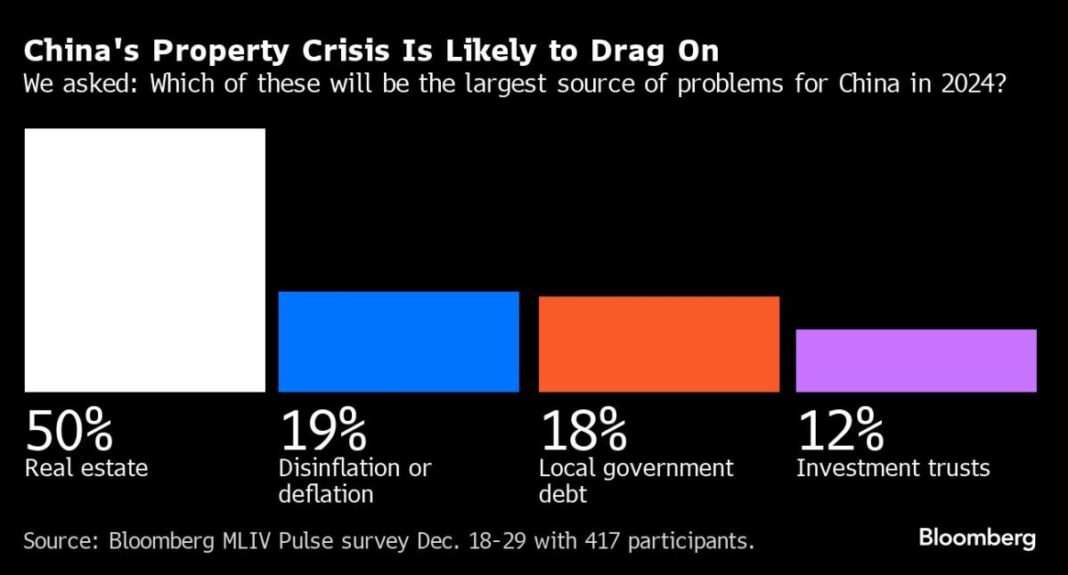

Chinese stocks peaked in early 2021 and have since slumped almost 60% to be languishing in a bear market, according to the MSCI China Index. The decline reflects a real estate debt crisis, eroding consumer confidence and China’s slowing economy. Now, the country’s stocks are among the world’s cheapest relative to their profits.

Some investors, including Invesco Ltd. and Pzena Investment Management, are beginning to take note.

“China is a market…