(Bloomberg) — The collapse in the shares of Paytm following India’s largest initial public offering is proving an expensive lesson for the firm’s early backers.

Most Read from Bloomberg

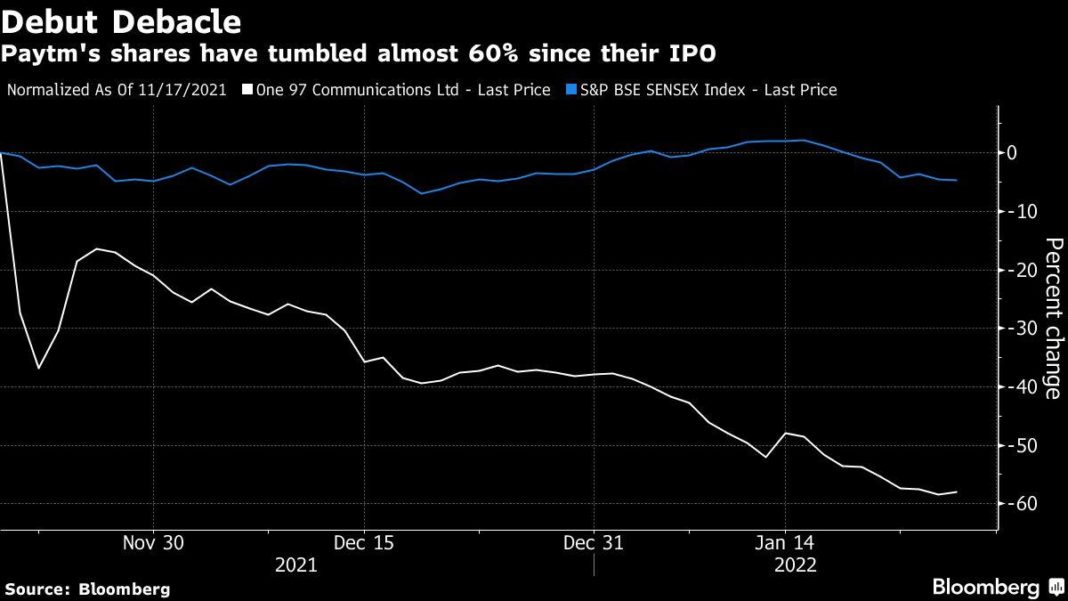

Paytm shares have tumbled 58% since the stock listed on Nov. 18. That’s cut the valuation of its parent One 97 Communications Ltd. to $7.8 billion from $20 billion.

SoftBank Group Corp.’s 2017 investment valued the Indian company at about $7 billion, according to people familiar with the matter. Berkshire Hathaway Inc. invested in One 97 when the company was valued at more than $10 billion in 2018, and T. Rowe Price Group Inc. invested at a $16 billion valuation the following year, the people said.

Paytm is struggling to convince investors and analysts alike of the potential for the digital payment giant’s business model. Losses widened to 4.74 billion rupees ($63 million) in the…