Small-capitalization stocks have been hit particularly hard over the past months. A look at the Russell 2000, the leading index of small caps, tells the story. The Russell last hit a record high back in November of last year, and it’s gone mostly downhill from there — falling 20%.

But low prices now could translate into investor opportunities later on. In fact, Jefferies strategist Steven DeSanctis believes that the small caps are in a “bottoming out process.” DeSanctis argues that “valuations are getting a lot cheaper,” and that makes a circumstance in which investors could ‘buy the dip.’

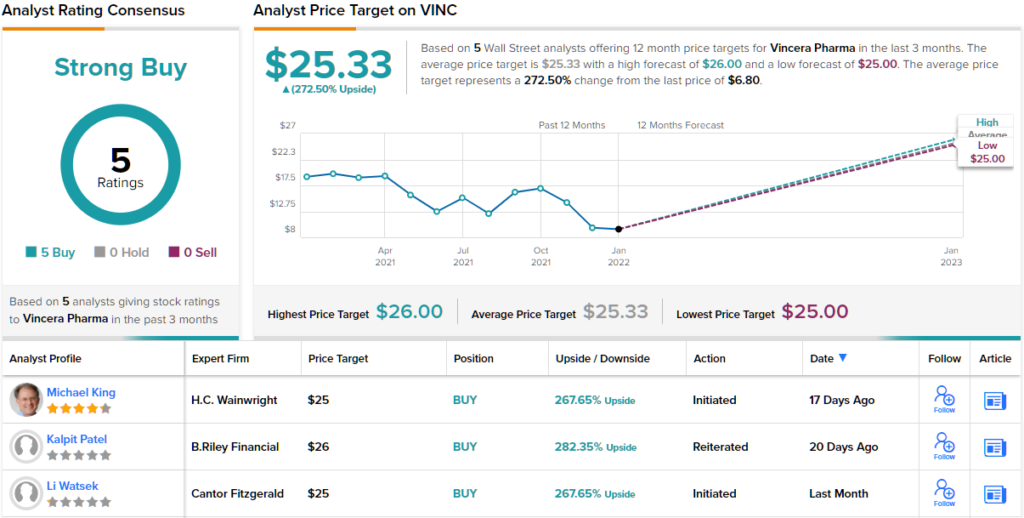

With this in mind, we delved into the TipRanks database and homed in on two small cap names that have seen steep recent losses – but still carry Strong Buy ratings from the analyst community. Both are trading for under $10 a piece, providing a low entry point with the prospect of at least…