It’s early innings in the current earnings season, with just 4% of S&P 500 companies having reported fourth-quarter 2021 earnings. According to FactSet data, 76% of those companies have reported actual EPS above estimates, while 90% have reported a positive revenue surprise. For Q4 2021, the blended earnings growth rate for the S&P 500 has clocked in at 21.8%, which could mark the fourth straight quarter with earnings growth above 20% if the earnings trajectory remains unchanged.

Of the Big Oil group, Hess Corp. (NYSE: HES) led things off Wednesday, reporting Q4 Non-GAAP EPS of $0.85, beating the Wall Street consensus by $0.12 while revenue of $2.26B (+59.2% Y/Y) beat by $290M.

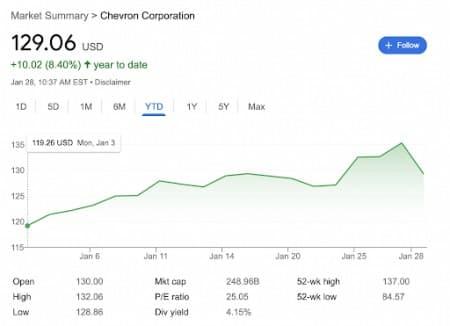

On Friday, Chevron Corp. (NYSE: CVX) and Phillips 66 (NYSE: PSX) reported earnings that soundly beat analyst expectations. Chevron reported a wild $5.1-billion profit and earnings that beat anything it’s seen…